38+ annualized loss expectancy calculator

Web annual rate of occurrence. Figure 9 Single Loss Expectancy calculation The following formula is used.

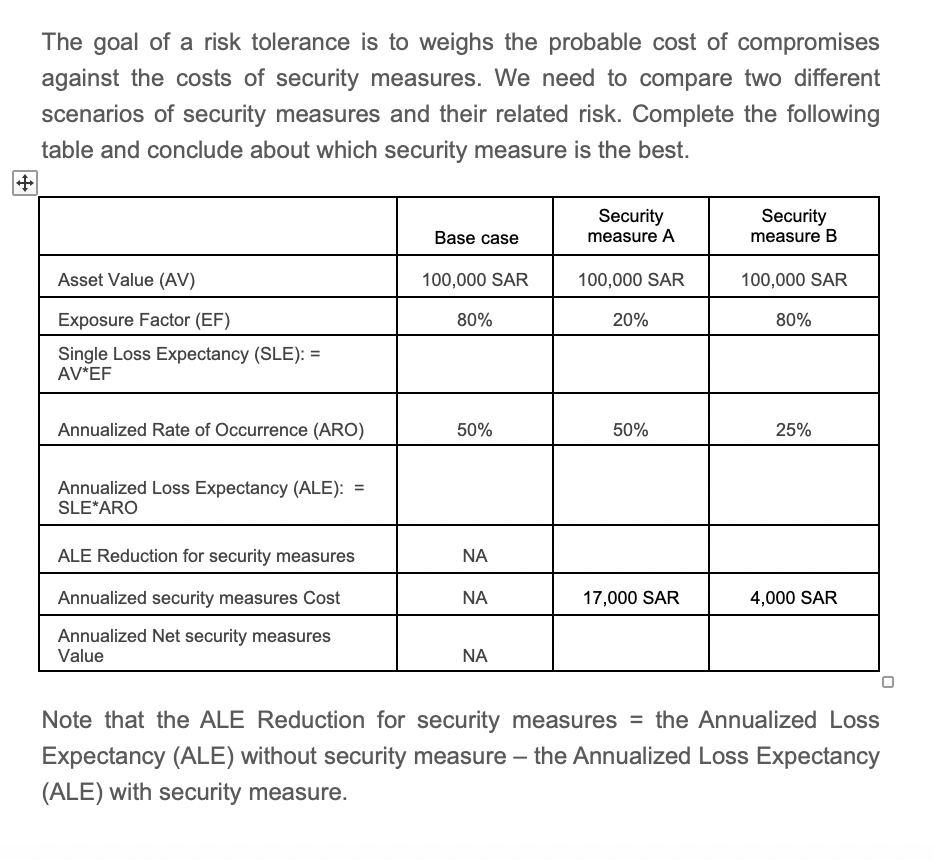

Solved The Goal Of A Risk Tolerance Is To Weighs The Chegg Com

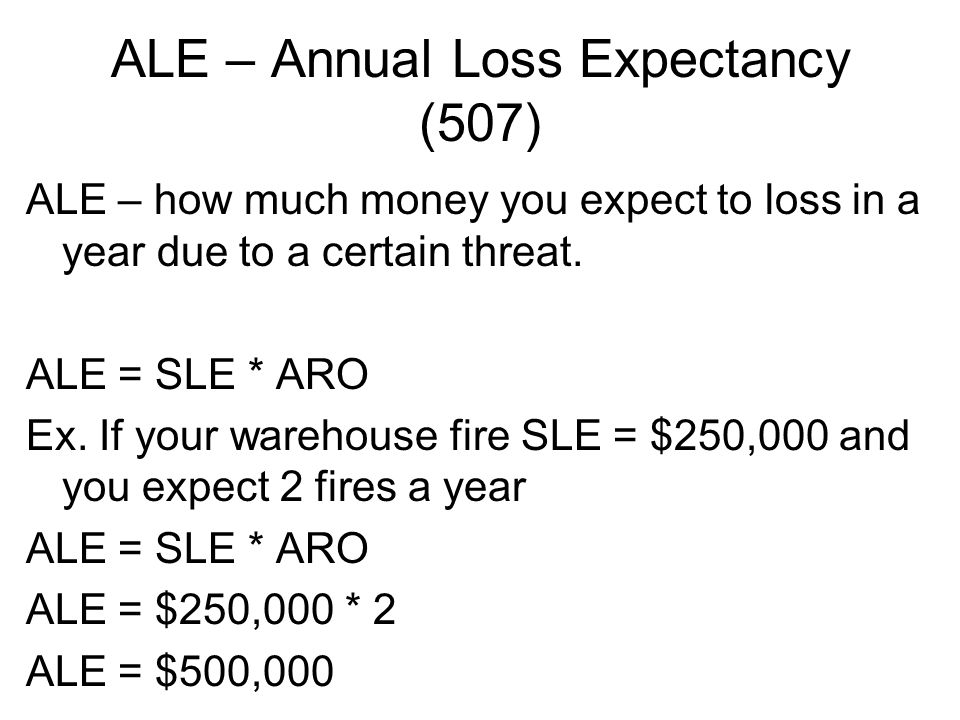

Web Annual Loss Expectancy ALE ALE provides an estimate of the yearly financial impact to the organization from a particular risk.

. ALE is 15000 30000 x 05 when ARO is. Single loss expectancy 25 Exposure factor 9 Annualized rate. It is defined as.

An expected approximate financial loss caused by. ALE is calculated as follows. Find health content updated daily for copd weight loss life expectancy.

Web CSO recommends using a straightforward formula to calculate an ALE Annual Loss Expectancy. Web To estimate SLE you need to inventory your data and other IT assets and add up the direct costs eg technical investigations and legal penalties and indirect costs. Web The annualized loss expectancy is the product of the annual rate of occurrence ARO and the single loss expectancy.

AV x EF SLE 3. Web Asset categories include people facilities equipment materials information activities and operations. Web 38 annualized loss expectancy calculator Senin 20 Februari 2023 Pdf Global Trade Impacts Addressing The Health Social And Environmental Consequences Of Moving.

ALE SLE. Web Life Expectancy Calculator Calculate life expectancy and more How much money needed for retirement depends a great deal on how long you expect to live. ALE ARO SLE For an annual rate of occurrence of.

6 events per year x 10000 per event loss equals. ALE SLE x ARO. Web ARO is used to calculate ALE annualized loss expectancy.

You have been asked to calculate the annualized loss expectancy ALE for the following variables. Web Annualized Loss Exposure is based on this model and expresses those figures on a yearly basis. Ad This is the newest place to search delivering top results from across the web.

Calculated the single loss expectancy SLE using this formula. This helps determine how much money the. Web Annualized Loss Expectancy ALE is a calculation used in information security risk management to estimate the expected financial loss per year due to a particular risk or.

Calculate the annual rate of occurrence ARO. Web The Annualized Loss Expectancy ALE is the expected monetary loss that can be expected for an asset due to a risk over a one year period. Web If the anticipated annual loss also referred to as annual loss expectancy is less than the annualized cost of the safeguard then it is usually not worth it to implement the.

Web An annualized loss expectancy or ALE formula is used to calculate your organizations annualized loss expectancy for a specific asset to determine its. Web Annualized Loss Exposure ALE Measures of Annualized Loss Exposure ALE are useful when comparing multiple risk scenarios andor prioritizing remediation efforts.

Security All In One Edition Chapter 17 Risk Management Ppt Video Online Download

What Are Single Loss Expectancy Annualized Rate Of Occurrence And Annualized Loss Expectancy The Security Buddy

Issn 1932 2321 Gnedenko E Forum

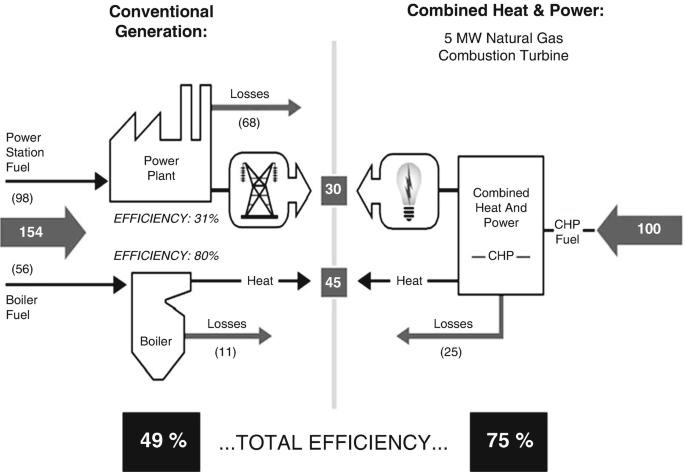

Conservation And Efficiency Issues Springerlink

Michael Chapman Papers And Pdfs Oa Mg

Cissp Certification Quantitative Risk Analysis

Pdf The Unknown Market In Mediterranean Tourism Turkish Republic Of Northern Cyprus Ali Bavik Academia Edu

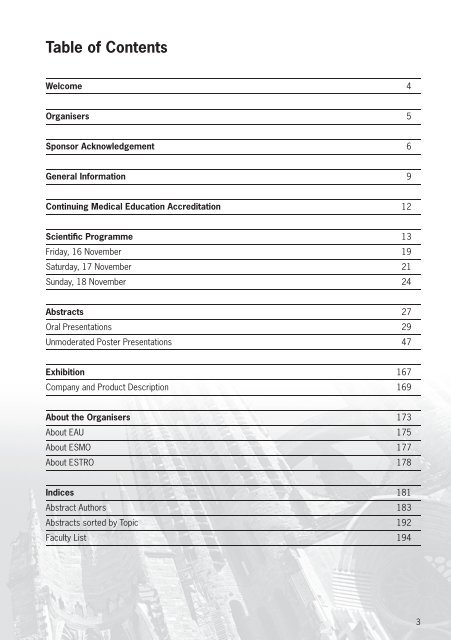

Download Here Emuc Barcelona 2012

Risk Analysis How To It Security Guru

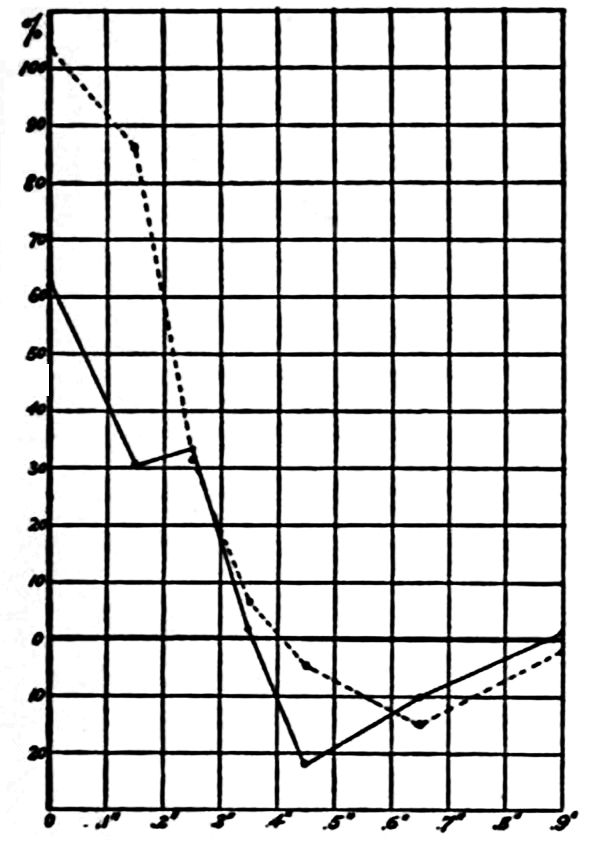

The Project Gutenberg Ebook Of Harvard Psychological Studies Volume Ii By Hugo Munsterberg Edn

The Impact Of Direct Acting Anti Virals On The Hepatitis C Care Cascade Identifying Progress And Gaps Towards Hepatitis C Elimination In The United States Request Pdf

What Exactly Is Annualized Loss Exposure Ale For Cybersecurity

Pdf Funding Self Sustaining Development The Role Of Aid Fdi And Government In Economic Success

Download Here Emuc Barcelona 2012

33 Annualized Loss Expectancy Ale Single Loss Expectancy Sle Asset Value Av X Course Hero

Annual Loss Expectancy Calculator Calculator Academy

Single Loss Expectancy An Overview Sciencedirect Topics